tucson sales tax on food

The current total local sales tax rate in Tucson AZ is 8700. He is seeking to use the gas tax increase that Ivey supported as a wedge issue with primary voters.

Retail Sales Food For Home Consumption Arizona Department Of Revenue

Wayfair Inc affect Arizona.

. BOISE Idaho AP A proposal to increase by 20 the amount Idaho residents can recover on taxes paid on food through the grocery sales tax credit headed to the full Senate on Thursday. Did South Dakota v. All regional property tax rates for Pima County can be viewed through the following link.

Tumacacori AZ Sales Tax Rate. Real Estate Taxes Amount. Vail AZ Sales Tax Rate.

Sales taxes go to the city county and state governments. One exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new Honda Accord costing 25000. Groceries are exempt from the Tucson and Arizona state sales taxes.

Tucson collects a 3 local sales tax the maximum local sales tax allowed under Arizona law. The nations sixth-largest city is ready to begin phasing out an emergency sales tax on food that was added in 2010 to address a massive budget. Pima County - Property Tax Rates.

The Arizona sales tax rate is currently. The December 2020 total local sales tax rate was also 8700. 07-07-2019 0942 PM exit2lef.

This is the total of state county and city sales tax rates. If you do not separately. If you do not separately itemize the tax you may factor.

3 hours agoRight now if you live in Kansas you are paying the second highest state sales tax on groceries in the US and this bill would eliminate that. This page describes the taxability of food and meals in Arizona including catering and grocery food. There is no applicable special tax.

The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. Tucson AZ Sales Tax Rate. Tucson AZ Sales Tax Rate.

In Tucson you do not pay sales tax on unprepared food bought in grocery stores but you do pay tax on meals in restaurants. When were in a 1 percent business thats a lot of money he said. While Arizonas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

The Tucson sales tax rate is. At a council meeting Monday Basha suggested that a reconsideration of the citys 25 percent tax on food for home consumption could help ease the pain. Tusayan AZ Sales Tax Rate.

Tucson Estates AZ Sales Tax Rate. The Senate Local Government Taxation Committee voted to approve the bill. To learn more see a full list of taxable and tax-exempt items in Arizona.

1-800-870-0285 email protected. Tumacacori-Carmen AZ Sales Tax Rate. Gilbert 15 percent Chandler 15 percent Peoria 16 percent.

The city ranked appreciably higher five years ago but a. One exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new Honda Accord costing 25000. The following cities in the Phoenix metro that do have a sales tax on food are the following.

Utting AZ Sales Tax Rate. Tubac AZ Sales Tax Rate. You can print a.

Kansas Senate tax committee Chair Caryn Tyson R-Parker speaks in favor of a Republican proposal to phase out the states sales tax on groceries over three years Wednesday April 27 2022 at. Prices in stores are fixed. Bill to boost Idaho grocery sales tax credit heads to Senate.

Tucson has a lower sales tax than 571 of Arizonas other cities and counties. BOISE Idaho AP Idaho Gov. By KEITH RIDLER March 17 2022.

Sales Transfer Tax Percentage. If you itemize tax separately on your customers receipts and keep records of it on your books you may take the actual tax collected as a deduction. Vaiva Vo AZ Sales Tax Rate.

The sales tax jurisdiction name is Arizona which may refer to a local government division. The City of Tucson receives 2 tax from all taxable sales by businesses located within the city limits regardless of the customers location. What is the sales tax rate in Tucson Arizona.

In Kansas theres a. Sahuarita Sedona Superior Surprise Tombstone Tucson not including the municipality of South Tucson which does tax groceries Tusayan Williams. Real Estate Taxes Amount.

Sales Affiliates and Partnerships. Brad Little has signed into law a 20 increase in the amount Idaho residents can recover on taxes paid. If you itemize tax separately on your customers receipts and keep records of it on your books you may take the actual tax collected as a deduction.

As you can see to obtain a foodbeverage tax in Tucson Arizona FoodBeverage Tax you have to reach out to multiple agencies at various levels of government including federal state county and local level offices. The people of Alabama are fed up James said during a news. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

The minimum combined 2022 sales tax rate for Tucson Arizona is. The County sales tax rate is. Sales Transfer Tax Percentage.

Tucson has the 33rd highest sales tax in the country at 87 percent to fund a mix of government actions. WHO RECEIVES THE RETAIL SALES TAX. Sales Tax On Food.

Sales Tax On Food. The City of Tucson receives 2 tax from all taxable sales by businesses located within the city limits regardless of the customers location. James said he supports a repeal of the 10-cent-per-gallon gas increase approved in 2019 as well as a repeal of the states sales tax on food and business privilege tax.

Is Food Taxable In Arizona Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Hyundai Tucson Price Pakistan Vs Rest Of The World Hyundai Tucson Hyundai New Suv

It S National Pancake Day Free Short Stack Of Pancakes You Get A Pancake Everyone Gets A Pancake Ihop Pancake Stack National Pancake Food

To Learn More About This Apartment For Sale At 3455 N 2nd Ave Tucson Az 85705 Contact Omer Kreso Realtor Realty Executives Tucson Elite 520 247 7480 Apartments For Sale Realty House Styles

Culver S Tucson Az Food Crispy Chicken Sandwiches Best Fast Food Burger

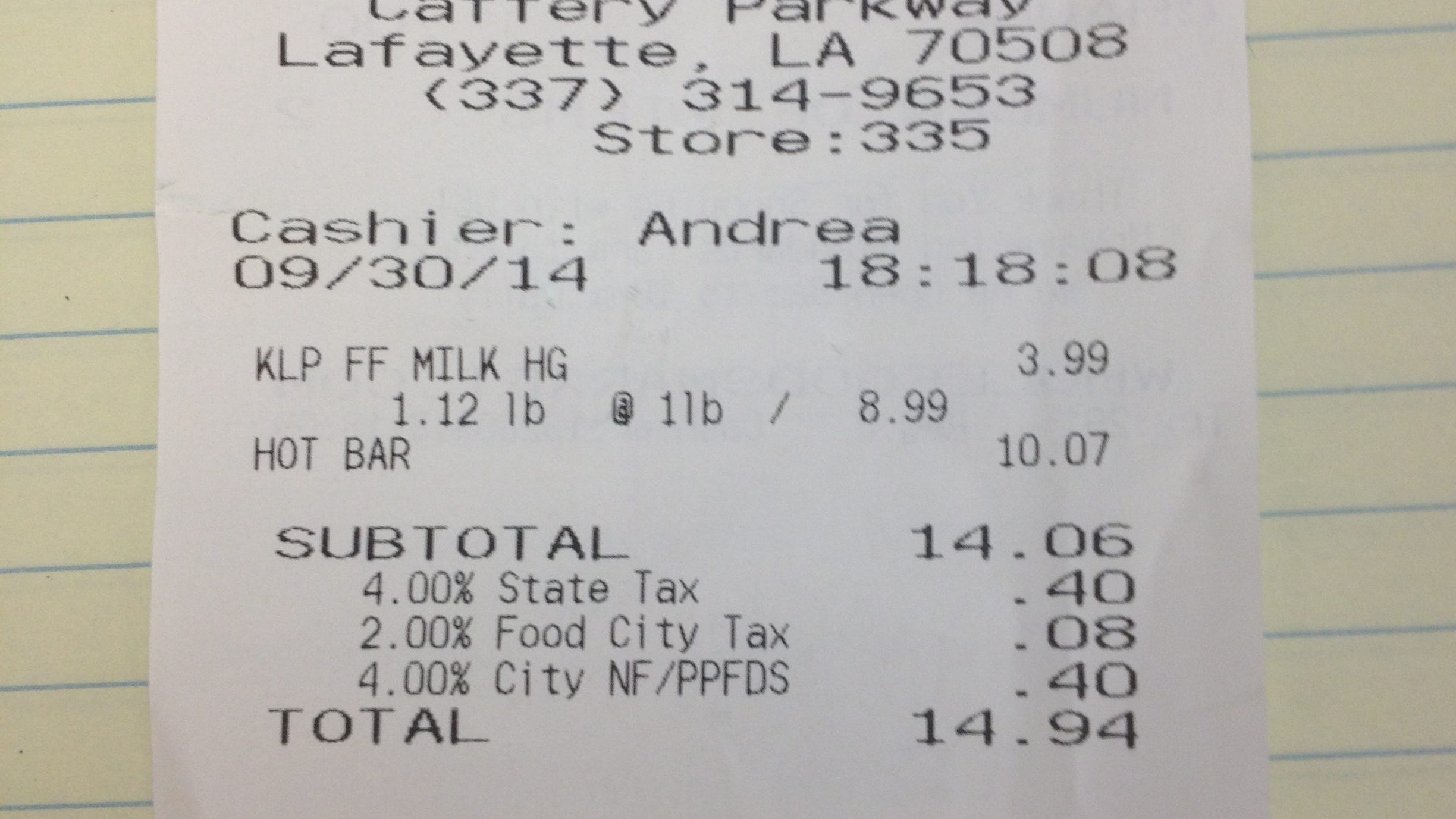

Whole Foods Collecting The Right Amount Of Sales Tax

Best Fertilizer For Tomatoes And Peppers A Prima Tax Company 2018 2019 2020 Hydroponics Plant Food Tomato Fertilizer

Is Food Taxable In Arizona Taxjar

I Took Advantage Of The 58 Cent Pancakes Ihop Yesterday The Butter Pecan Syrup Is Awesome Butter Pecan Syrup Food Ihop Pancakes

Borderlands Food Bank Nogales Az 85621 Reduce Food Waste Nogales Food Waste

Help Pay Our Gas Bill Gas Bill Go Fund Me Gas

The Ultimate Breakfast Served By My Friend The Beautiful Kc Villageinn Ultimate Breakfast Food Breakfast

Hyundai Tucson Vs Kia Sportage A Comparison Kia Sportage Hyundai Tucson Hyundai

Tax Tip Of The Week Www Pinpointeaccounting Com Pinpointe Accounting Services Pc Phone 520 795 750 Accounting Services Accounting Firms Tax Preparation

The Coupons App 1 Most Popular Download For Android Iphone Fast Food Coupons Free Printable Coupons Printable Coupons

3 99 For A Qt Lunch Bye Waffle House So Hot And Tasty Waffle House Quick Meals Thank You Come Again

Artistic And Quirky A Walking Tour Of Barrio Viejo In Tucson Local News Tucson Com Walking Tour Texas Rangers Tucson